Web Travel Group (ASX:WEB) – World’s second largest bed bank set to take market share in a fragmented market

Rating: Buy

Confidence: Medium

Current share price: $4.65

Web Travel Group (ASX:WEB) is the second largest bed bank in the world. It was demerged out of Webjet Ltd on 27 September 2024. Prior to 2013, Webjet Ltd, which traded under the ticker WEB, was a B2C online travel agency in Australia and New Zealand. In 2013, Webjet Ltd entered the B2B market by establishing ‘Lots of Hotels’ in Dubai. This business, through a number of acquisitions, has evolved to become what we now refer to as ‘WebBeds’ today. Over the past decade, the B2C business has faced considerable industry headwinds. The OTA (Online Travel Agency) industry that it operates in has struggled as global behemoths like Booking.com (NASDAQ:BKNG) and Expedia (NASDAQ:EXPE) have taken significant market share. On the other hand, Web Travel Group, the B2B business, has quietly rocketed – going from doing $14k TTV in its first month in 2013 to now doing $4bn TTV in FY24. This has led Webjet Ltd to ‘let the Ferrari out of the garage’ by demerging the two businesses with the B2B business retaining the WEB ticker and the B2C business being listed separately under the ticker WJL. Despite the demerger, many retail investors are still unaware that the B2B business exists and instead confuse it with the B2C business – the brand that most Australians and New Zealanders are familiar with.

What is a Bed Bank?

If you have never heard of a bed bank before, you are probably not alone. It is a relatively new industry with most of the largest bed banks being founded in the early 2000’s. It is also an obscure industry that operates out of sight of the public eye.

Bed banks provide a network of high-tech infrastructure that facilitates the distribution of travel inventory through the global wholesale travel market. They essentially act as the ‘middle man’ between travel suppliers (such as hotel chains, independent hotels, transfer and sight-seeing companies) and travel buyers (such as travel agents, corporate travel managers, tour operators, and travel apps). Bed banks will source inventory from travel suppliers, aggregate it on their platform, and then sell it to travel suppliers (who then on-sell it to the traveling public). As the distribution of inventory is entirely handled through technology, bed banks can leverage real time inventory availability and dynamic pricing to ensure that inventory is distributed through the market as efficiently as possible.

Brief History of Bed Banks

Before bed banks came into existence, travel wholesalers relied on traditional, labour-intensive methods of communication, such as phone calls and faxes, to distribute hotel inventory through the wholesale travel market. This distribution model was very inefficient as it required hotels to deal directly with dozens of wholesalers across the world. It was also very resource intensive as travel suppliers had to continually provide updates on inventory availability and pricing to wholesalers.

The emergence of bed banks in the 1990s and early 2000s revolutionised the industry, disrupting the traditional distribution model entirely. By leveraging technology, bed banks simplified and centralised inventory distribution, allowing thousands of travel buyers and suppliers worldwide to connect with each other in real time. As the internet grew in popularity, the travel industry slowly began to shift online, rendering traditional travel wholesalers obsolete.

Business Model of Bed Banks

The business model of bed banks can be considered in three parts:

Sourcing inventory

Bed banks will source inventory by entering into contracts with third party suppliers, independent hotels (direct contracts), and global hotel chains (chain agreements).

Contracts can either be fixed or dynamic. Under fixed contracts, the bed bank is allocated a fixed amount of inventory over a specific period at a fixed price. Under dynamic contracts, the bed bank is allowed to source inventory from the travel supplier on a real time basis based on inventory availability. As inventory is dynamically sourced, the price and availability of inventory can fluctuate based on market demand under dynamic contracts.

These contracts are usually negotiated at a slight discount to the travel supplier’s advertised rates (the net rate). In exchange, the travel supplier gets the benefit of having its inventory promoted and sold on the bed bank’s platform, as well as bespoke marketing and sales activations.

Bed banks will then add a markup. This markup tends to remain stable through the year, even as hotel rates fluctuate seasonally. However, travel suppliers will charge different rate types at different times of the year to manage availability (i.e. non-refundable rate, flexible cancellation rate, and last minute rate).

As an example, a room that may be publicly advertised at €100, might be negotaited at a net rate of €90. The bed bank will then add a €10 markup to the net rate when selling to travel buyers. In this example, the travel buyer would pay €100, the hotel would receive €90, and the bed bank would receive €10.

It is important to note that almost all bed banks operate under a partnership model. This model only gives bed banks the right to purchase an allotment of inventory. The alternate pre-buy model involves the bed bank taking risk by pre-buying inventory from the travel supplier. I will touch on the pre-buy model later in the article.

In new geographical regions, bed banks will typically contract with third party suppliers (i.e. local travel agents) to source inventory in the region. These local travel agents will have local expertise and a portfolio of hotels in the area that the bed bank will source inventory from. Using third party suppliers is lower margin for the bed bank as the third-party supplier also need to make a margin on the inventory they sell.

Once a bed bank is comfortable in a geographical region, the bed bank will begin employing Contract Managers who are responsible for signing direct contracts with the independent hotels in the region. The main advantages of direct contracts are that they offer higher margins than going through third-party suppliers and they can give the bed bank the exclusive right over other bed banks to sell the hotel’s inventory on their platform. Once a hotel enters into a direct contract with a bed bank, the Contract Manager becomes the hotel’s main point of contact, and he/she is responsible for maintaining the relationship with the hotel. Direct contracts are typically renewed every six months.

For larger hotel chain agreements, bed banks will enter into chain agreements. These contracts are evergreen and typically not exclusive.

Aggregating inventory

Once a bed bank has sourced inventory, it will connect the travel supplier’s channel manager and inventory management software to its API so it can process real time data on inventory availability and pricing.

The travel supplier’s inventory will then begin to appear on the API and be available for travel buyers to purchase.

Selling inventory

Travel buyers will either use the API (preferred by OTAs) or the trade booking site (preferred by retail travel agents) to purchase inventory.

For OTAs, the API essentially acts as the back-end of their website. All of the data displayed on their website relating to inventory sourced from the bed bank will be pulled from the bed bank’s API.

Travel buyers will offer inventory to the traveling public at a marked-up price as to what the bed bank is offering. When a travel buyer makes a sale to the traveling public, they purchase inventory from the bed bank to make that sale. The bed bank, then in turn, exercises its right to purchase the inventory from the travel supplier. If there are no issues with availability, the sale is made, and the reservation is confirmed.

Travel buyers can either make payment to the bed bank upfront or operate on credit terms, settling the payment at a later date.

Travel suppliers are typically paid after the bed bank receives the money from the travel buyer.

The total amount paid to the bed bank by the travel buyer is referred to as the TTV (Total Transaction Value). The bed bank’s markup is recognised as revenue. TTV revenue margins are calculated by dividing revenue by TTV.

Bed Banks’ Role in the Broader Travel Industry

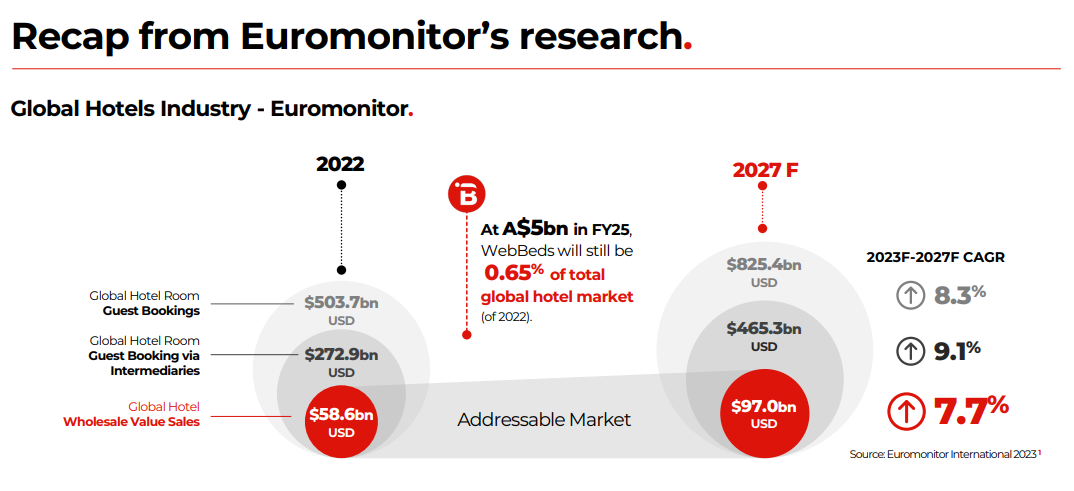

Bed banks only form a small part of the distribution network of the global travel market. According to a report released by Euromonitor, there were around $500bn USD worth of global hotel room bookings in 2022. Of the $500bn:

Approx. $230bn (46%) was distributed direct-to-consumer (i.e. hotel’s websites)

Approx. $210bn (42%) was distributed direct-to-travel agent (i.e. OTAs and retail travel agents)

Approx. $60bn (12%) was distributed through the wholesale market (bed banks)

Competition between Different Channels

Bed banks do not compete with direct-to-consumer channels. They are actually designed to complement both direct-to-consumer and direct-to-travel-agent channels. Bed banks play a key role in helping hoteliers develop under-served markets. They are particularly effective at reaching international travelers, who are often difficult to target through other channels. The world’s largest bed bank, Hotelbeds, have reported that 60% of bookings made through their network come from non-domestic source markets.

While bed banks complement direct-to-travel agent channels, they also compete with them. Bed banks operate within a coopetition framework where they both sell to and source inventory from travel buyers. For example, a bed bank might source unique inventory from an OTA, while also selling that OTA the bed bank’s directly contracted inventory. This creates a mutually beneficial relationship where both the bed bank and the travel buyer benefit from each other’s success.

The competition between bed banks and travel agents mainly revolves around sourcing inventory. The behemoth OTAs, such as Bookings.com and Expedia, source inventory dynamically. This means that they source inventory in real time based on fluctuating prices. As these behemoth OTAs grow, hoteliers allocate more inventory to them, resulting in bed banks losing out on inventory that otherwise would have been allocated to them.

In saying that, bed banks and travel agents usually compete for different types of inventory.

As you can see from the above table, bed banks have a broad customer mix in comparison to travel agents who predominantly sell to price-sensitive leisure customers. As bed banks are focused on helping hoteliers develop under-served markets, they tend to sell a disproportionate amount of their inventory to difficult to reach customers, such as corporate and travel groups. This results in bed banks attracting higher-quality customers who book further in advance, stay longer, and cancel less. As a result, bed banks prioritise sourcing inventory that caters to these preferences, while travel agents similarly seek inventory that best aligns with the needs of their customers.

Web Travel Group

As of March 2024, WebBeds has over 430,000 hotels on their platforms across over 16,000 destinations and 190 countries. This consists of:

31,000+ directly contracted hotels (exclusive to WebBeds)

62,000+ directly contracted chain properties

The remaining hotels (around 337,000) sourced through 70+ third-party suppliers

In addition to this, WebBeds also sells ground service inventory on their platform, including:

12,000+ global DMC (Destination Management Company) services

18,000+ transfer products

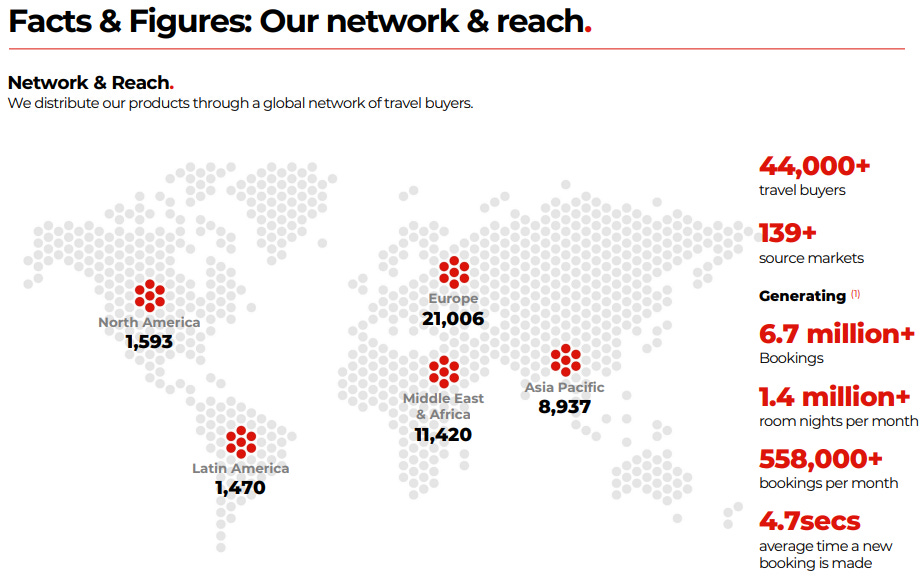

In terms of travel buyers, WebBeds has over 44,000 travel buyers across over 139 source markets. This consists of:

Online travel agencies

Retail travel agents

Corporate travel managers

Tour operators

Wholesalers

Tourism boards

Apps

Destination management company

Loyalty programs

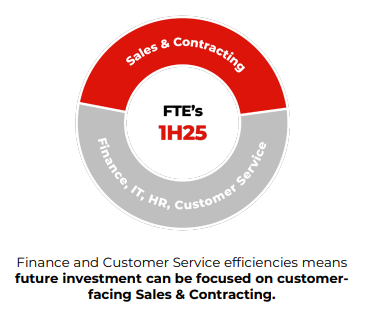

WebBeds has over 2,000 employees working in 120+ cities across 50+ countries.

Competitors

When it comes to sourcing inventory, WebBeds’ primary competition comes from other wholesalers/bed banks. Beyond that, behemoth OTAs like Booking.com are WebBeds’ second-largest competitor.

Competing Wholesalers/Bed Banks

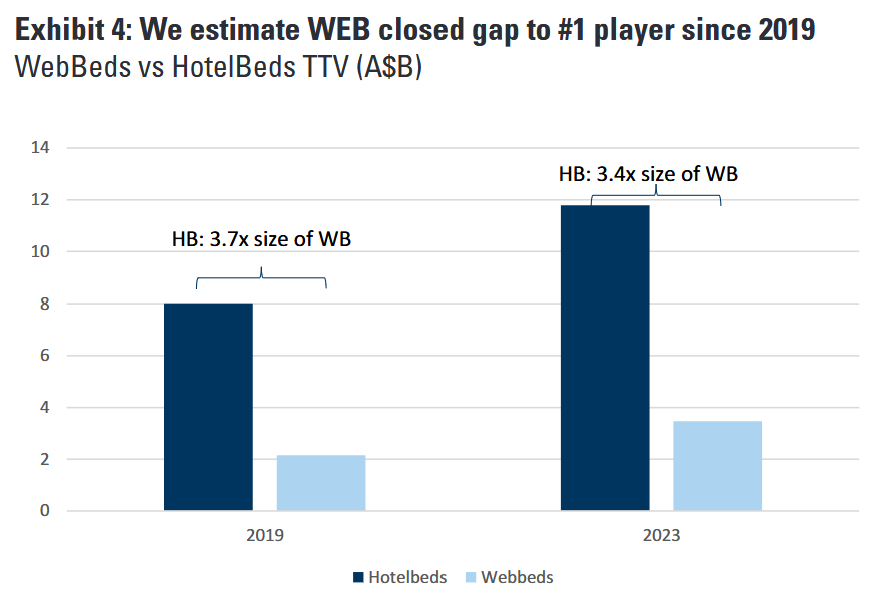

Hotelbeds is the largest player in the bed banks industry. It holds a market share of 13% - just over three times that held by WebBeds. Hotelbeds was founded in 2001 by First Choice Holidays who later merged with TUI Group. It was spun out of TUI group in 2007 and bought by private equity firm Cinven and the Canada Pension Plan Investment Board for €1.1bn. In FY24, Hotelbeds posted around €7.3bn in TTV, €693m in revenue, and €363m in EBITDA. Recently, the private equity owners of Hotelbeds have been exploring the possibility of an IPO, with valuations for the company ranging between €4.5 and 5.5bn. It is said that they are only looking to divest €1bn - a great sign for WebBeds as it suggests they still see the company as having a long runway of growth ahead of it.

There is a significant gap to the third largest bed bank, Expedia Partner Solutions, who does 30 to 40% of the volume of WebBeds and only holds 1% market share. Expedia Partner Solutions is the bed banks division of Expedia. It falls under Expedia’s B2B segment, but it is not the only part of the segment, with the segment also including several other businesses, including Expedia TAAP, Expedia PrivateLabel Solutions, and Egencia. As Expedia Partner Solutions is only a small part of a giant company, it is fair to say that it probably doesn’t get the attention it needs.

Then, there are dozens of smaller wholesalers and bed banks, most of whom just don’t have the high tech solutions or significant aggregation to compete meaningfully with the larger bed banks. However, there are a few wholesalers and bed banks whose competitive advantage is to specialise in a region or type of inventory (i.e. Bonotel is a wholesaler who specialises in luxury travel).

Behemoth OTAs

In the travel agent industry, which today is dominated by OTAs, Bookings.com and Expedia are the two largest players. Together, these behemoth OTAs hold a combined market share of around 60-70% of the industry. They use their dominance of the travel agent industry and broader travel industry to continually source greater allocations of inventory.

Wholesale Market Disruptors

Despite the wholesale market existing since the rise of commercial aviation and international travel in the 1950s, many analysts have argued that the wholesale market is in structural decline and will eventually cease to exist, believing that wholesale market disruptors or OTAs will replace it. This belief demonstrates a complete lack of understanding as to why the wholesale market exists.

The wholesale market has always existed, and will continue to exist, to serve difficult to reach customers. This is achieved by bed banks providing a pipe through which the wholesale global travel market can transact. If that pipe was removed, hotels would have to deal with dozens of travel buyers from different source destinations around the world in order to sell inventory to a diverse customer base. Such a disjointed model of distribution, would also result in inefficiencies and parity issues with so much inventory popping up from disparate sources.

An example of a wholesale market disruptor is HyperGuest. This company is seeking to remove bed banks as the ‘middle man’ between travel suppliers and travel buyers. Their platform connects travel suppliers and travel buyers directly, allowing hotels to set terms and negotiate rates with every travel buyer that they want to do business with. As I’ve touched on, hotels do not have the time or resources to be dealing with so many travel buyers.

Competitive Advantages

While WebBeds competes indirectly with travel agents, their true direct competitors are other competing bed banks. WebBeds’ competitive advantages over competing bed banks can be considered in two regards: their competitive advantages over smaller bed banks, and their competitive advantages over Hotelbeds.

WebBeds’ Competitive Advantages over Smaller Bed Banks

WebBeds’ consolidated market positions gives it a number of competitive advantages over smaller bed banks, including:

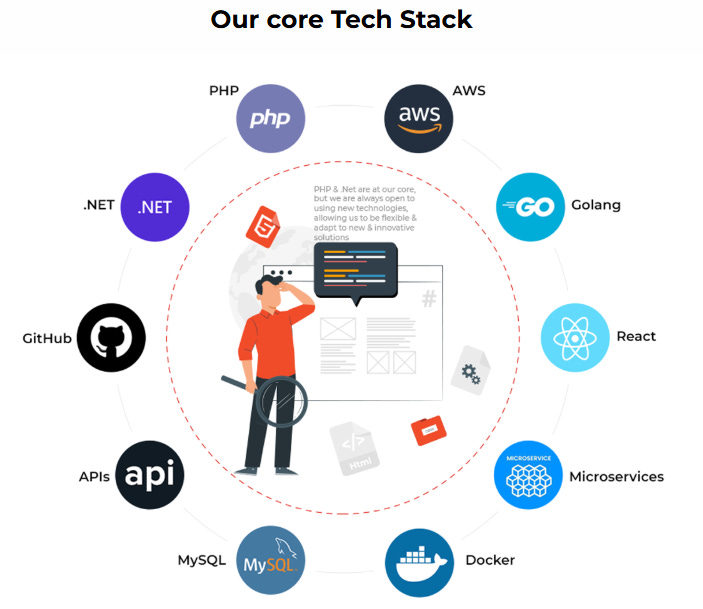

The ability to offer a high-tech solution and be able to re-invest in technology

The ability to offer high-tech solutions is paramount in the bed banks industry. WebBeds already has one of the best tech stacks in the industry, with its API reaching peaks of 50,000 requests per second.

As the second largest player in the industry, WebBeds has a significant advantage when it comes to investing in their tech stack. Currently, WebBeds budgets for and spends approx. $25-$30m annually in growth CAPEX on their tech stack. If the third largest bed bank, Expedia Partner Solutions, spent that much, it would likely consume their entire annual free cash flow. This enormous capacity for ongoing technological investment will likely create a compounding effect, positioning WebBeds (and Hotelbeds) to further consolidate the market as their tech stacks continue to improve at a rate far superior to their smaller competitors.

The network effect of significant aggregation

The bed banks industry is an industry where the big players benefit from scale due to the network effect. As bed banks grow, they onboard more travel suppliers, which in turn, brings more travel buyers as these buyers want to use platforms with the best aggregation. As more travel buyers use the platform, it drives more booking volume, allowing the bed bank to negotiate deeper discount rates and greater allocations with the travel supplier. This results in the bed bank building a considerable competitive advantage, preventing smaller competitors from significantly disrupting their market position. As WebBeds and Hotelbeds have by far the best aggregation in terms of direct contracts and travel suppliers, it is likely that they will continue to further consolidate the market.

Being the second biggest player in an industry where the winners take all

In the bed banks industry, there is limited room for small players to thrive. According to Managing Director of Web Travel Group, John Guscic, for a bed bank to remain relevant and competitive, it must account for at least 1% of total hotel sales. This means that due to the small share that the wholesale market makes up of overall distribution, there is only really room for hotels to be dealing with two to three bed banks at once. As the second largest player in the industry, WebBeds is well positioned to be at least one of the bed banks that hotels partner with. It is my view, that if they aren’t already, WebBeds and Hotelbeds will become the ‘Big 2’ of the bed banks industry. As an example of the consolidation alrready going on, see the below announcement by Leading Hotels of the World where WebBeds and Hotelbeds were announced as the exclusive B2B distribution platform partners of the chain.

The technology to combat rate parity issues

One of the biggest issues hotels deal with is rate parity. Rate parity is the practice of maintaining consistent hotel rates across all distribution channels to avoid price discrepancies that can create unfair competition. This is particularly important in the bed banks industry where inventory is often distributed in convoluted ways. For example, inventory can be sold multiple times by different intermediaries before it reaches its final buyer. Due to this, it is often difficult to know exactly who along the chain is responsible for the rate parity issue. By investing in technology to address rate parity issues, bed banks can maintain trust and build stronger relationships with hotels. This is a significant competitive advantage for smaller bed banks who don’t have the resources to invest in rate parity technology.

Both WebBeds and Hotelbeds have invested significantly in rate parity tools. WebBeds has its own internally designed tool called Parity Monitor, where as HotelBeds has partnered with RateGain to use their software Parity+. They also both have internal teams dedicated to monitoring and investigating rate parity issues. To give you an idea of the magnitude of rate parity issues in the market, when Hotelbeds implemented Parity+ in 2019, they ended-up giving up €300m of sales over the course of a year as a result of rate parity issues.

WebBeds’ Competitive Advantages over Hotelbeds

I can actually only identify competitive advantages that Hotelbeds have over WebBeds, rather than the other way around. These include:

Pre-buy agreements

As far as I’m aware, Hotelbeds is the only bed bank in the industry, at least of its scale, that enters into pre-buy agreements with hotels. Pre-buy agreements are agreements where bed banks pre-purchase inventory from hotels at deeply discounted rates. There are various forms of pre-buy agreements, and not all require prepayments.

The benefit of pre-buy agreements is that they are negotiated at deeply-discounted rates, meaning that the bed bank makes considerably higher margins (up to mid-teen margins) on the inventory The downside of pre-buy agreements is that they can be capital intensive, and can result in the bed bank bearing significant financial losses if they can’t sell the inventory.

In my view, the benefits provided by pre-buy agreements far outweigh the risks. When John Guscic was asked about the possibility of WebBeds venturing into pre-buy agreements on an earnings call on 22 November 2023, he was open to the idea and noted that it was currently being discussed by the Board. Now, he has put the idea to rest, maintaining that WebBeds will always operate under a capital-light, partnership model. I think management should review pre-buy agreements, particularly once the share buy-back ends, as a way to combat declining TTV margins.

Greater percentage of TTV derived from directly contracted hotels

As discussed before, direct contracts are higher margin than going through third-party suppliers, and are often exclusive. They also provide greater data insights, which in turn gives you better ownership of the customer. Due to this, the more direct contracts you can accumulate, the stronger MOAT you can build.

Hotelbeds derive greater percentage of their TTV from directly contracted hotels compared to Web Travel Group who operate under the partnership model and source a greater percentage of their TTV from third party suppliers.

Outlook

The outlook for WebBeds is largely dependent on TTV growth and TTV margins.

TTV Growth

In 2021, Webjet Ltd (at the time) set an aggressive target for the WebBeds business of achieving $10 billion in TTV by FY30. To meet that target, the company will need to grow TTV at a CAGR of 17% from here onwards. Management believes that there are three key pillars that will drive TTV growth:

Conversion – growth driven by selling higher volumes of inventory from existing travel suppliers

New customers, supply and markets – growth driven by onboarding new travel suppliers and buyers

Market growth – essentially the rate at which the wholesale market is expected to grow

As the wholesale market is only expected to grow by 7.7% p.a., WebBeds will need to achieve growth at twice the rate of the market to reach their FY30 target. Over the past four years, TTV growth has predominantly been driven by onboarding new travel suppliers. Now, management believes that the business has reached an inflection point, and growth will have to primarily be driven by conversion going forward. This will be achieved by selling a broader range of inventory from existing suppliers on the platform, improving systems and algorithms (i.e. increasing the penetration of each search on its API), utilising the sales/contracting team to drive sales, and upcoming investments in sales.

TTV Margins

The fall of WEB’s share price from a high of $9.25 in July 2024 (pre-demerger) to a low of $4 in October 2024 (post-demerger) has been entirely related to concern around TTV margins. For those not familiar with the situation, I will provide a brief summary of it below:

In FY24, WebBeds closed the financial year with TTV of $4bn and revenue of $328m, equating to a TTV margin of 8.2%. This was fairly consistent with the TTV margins delivered in previous years.

On 21 March 2024, Webjet Ltd announced at their investor strategy day that TTV margins for WebBeds would decline in the short-term and settle in the mid 7’s due to mix changes.

On 29 August 2024, Webjet Ltd guided to TTV margins for WebBeds of around 7% in 1H25 and noted that they expected margins to improve in 2H25. This was the first time the issues with European summer trading were raised.

On 14 October 2024, Web Travel Group shocked the market by announcing that 1H25 TTV margins would be around 6.5% and would stabilise at the rate going forward.

Since the fallout, management has provided a clear explanation as to what occurred, attributing the decline in TTV margins experienced during 1H25 to four factors (ordered from most important to least important):

Pricing in response to European summer trading – there were three major events that distorted European summer trading: the collapse of tour operator FTI (flooded the market with inventory), the Paris Olympics (reduced Paris in-bound bookings due to hotels being booked out in advance), and the Euros (reduced German out-bound travel). In response to these trading conditions, an active decision was made to drive volume by lowering prices. In the words of John Guscic, “we were pricing down on sales we would’ve got anyway”. This was clearly a bad decision, and I’d suggest that it was made without management knowing given that Global Pricing has now been made a direct report to the MD. I’d also suggest that the person who made the decision has now been fired given that WebBeds are currently advertising for a new Head of Global Pricing.

Change in supply and customer mix – WebBeds reported that during 1H25 they had seen a 2-3% shift in supply mix from directly contracted hotels to lower-margin third party suppliers. Additionally, they saw their top customers grow resulting in higher volumes with them at lower margins.

Customer financial incentive agreements – WebBeds noted that overrides were $7.5m higher than budgeted. This was likely a response to the higher volume they experienced driven by lowering pricing in Europe. All customer financial incentive agreements have now been reviewed and will remain in place.

Management distractions – the demerger and a number of changes in key personnel were cited as management distractions during the half.

Despite management providing these reasons for the reduction in TTV margins experienced during 1H25 and describing them as one-offs, they have maintained that TTV margins will remain impaired at 6.5% for at least the next three reporting periods. On the 1H25 earnings call, they did not really provide a clear reason for the permanent reduction in margins. In my view, there are two clear reasons:

Focus on conversion

If you listen to the past few earnings calls, John Guscic has made a number of statements indicating that TTV growth will be prioritised over TTV margins going forward. This includes that “I don’t really care what the EBITDA margins are … as long as we are improving overall EBIT result and increasing revenue” and “I’m not going to die on the altar of high margins”. On the 1H25 earnings call, he stated that “if our business was to sell the same stuff to the same clients as we have historically, there would be no margin degradation”. He then went on to explain how they have pivoted away from exclusively selling at high margins with existing customers, giving the example of selling a hotel room 1 day out (normally lower margin) vs. 30 days out (normally higher margin). This to me paints a clear that Web Travel Group have begun employing a strategy of chasing volume by selling lower-margin inventory on their platform.

European Union rate parity decision

While management neglected to provide a specific reason for the permanent reduction in margins during the 1H25 presentation, they essentially pointed towards Europe (which has historically been WebBeds’ highest margin region) as being a major cause of it by stating that incremental growth in the region will be at lower margins, while all other regions will remain the same. Many analysts have argued that a change in the competitive environment has caused the permanent reduction in margins in Europe, but I have not come across any evidence from the public earnings results of travel industry peers to support that theory. To me, the guidance of a permanent reduction in margins came off the back of the European Union Court of Justice’s rate parity clause decision. This decision was handed down on 19 September 2024 and it ruled that Booking.com's use of parity clauses, which prevented hotels from offering lower rates on their own or rival websites, was unnecessary - leaving the door open for national competition authorities to assess and potentially outlaw such clauses. In July 2024, before the decision was even handed down, Bookings.com pro-actively decided to remove the clauses from its agreements within the European Union.

The removal of rate parity clauses allows hotels to advertise lower prices through their direct-to-consumer channels without facing any consequences. This pushes customers away from using OTAs and other travel buyers who purchase inventory from bed banks, resulting in hotels becoming less dependent on bed banks. Due to this, bed banks will likely have to sell lower-margin inventory in Europe in order to keep growing. However, the full impacts of the decision are still yet to be seen, with many arguing that it won’t be as bad as expected due to OTAs and bed banks finding work-arounds (i.e. not promoting hotels who don’t enforce rate parity).

Forecasts

The below forecast is my base case for Web Travel Group over the next five years.

I have included the forecasts in an Excel doc so you can see how the formulas work and the comments I’ve made.

My forecasts are based on two major assumptions:

WebBeds achieves $10bn TTV FY30 target by taking share in a fragmented market and conversion

While WebBeds have been taking market share off Hotelbeds, it will not be necessary for them to continue doing so to achieve their FY30 target. The market is so fragmented that the two big players, Hotelbeds and WebBeds, will be able to grow TTV at a decent rate for quite some time. Additionally, John Guscic believes that both companies are still 10 years away from competing each other away so we are unlikely to see them engaged in a race to the bottom anytime soon.

TTV margins continue to decline as WebBeds chases volume by selling lower-margin inventory and the wholesale market experiences headwinds from the European rate parity clause decision.

This is quite a conservative assumption because TTV margins could very well remain at 6.5% for the next five years. Management has only guided to 6.5% TTV margins for the next three reporting periods, and have neglected to provide any further guidance. However, without having a crystal ball, there is probably somewhat of a chance that TTV margins continue to decline due to either selling lower-margin inventory or the impacts of the European rate parity clause decision.

Valuation

Based on my FY25 forecasts, Web Travel Group currently trades at a forward PER of around 30. However, the more appropriate metric for Web Travel Group would be EV/NPAT, given that they currently have $280m net cash on the balance sheet. On an EV/NPAT basis, it trades at around 25 times.

In terms of comparable businesses, given the lack of publicly-listed bed banks, Booking Holdings probably stands out as the best comparable. Both Web Travel Group and Bookings Holdings are capital-light, tech-driven businesses that operate under a ‘clip-the-ticket’ model. That said, I’d actually argue that Web Travel Group has far superior economics, boasting 50% EBITDA margins and 40% NPAT margins when the business is firing on all cylinders. As Bookings Holdings currently trades on a forward PER of around 25, I think the current valuation of Web Travel Group is fairly reasonable. Now, if you compare Web Travel Group to ASX-listed tech stocks (which I don’t see as unreasonable), the stock looks incredibly cheap, with most stocks trading on PERs of between 50 and 150.

The upside in Web Travel Group’s share prices requires us to look long-term. If my base case plays out over the next five years, the share price could reach anywhere in the price range of $15-20 based on the current valuation. This would translate to a total return of 226-334% or a CAGR of 22-27%. Even if there is a slight miss on the base case, we will still get some nice above-market returns.

Management

Web Travel Group is led by Managing Director, John Guscic. Before taking the helm at Webjet Ltd in 2011, Guscic worked in leadership positions at GTA, which was one of the world’s largest global travel wholesalers, before it was acquired by Hotelbeds in 2017. While at Webjet Ltd, he launched the WebBeds business and oversaw it as it went from doing $14k TTV in its first month to now doing $4bn TTV annually. In that time, he has returned shareholders 419% (including dividends), equating to an annualised return of around 13%.

Not only is Guscic a high-class operator, he is also incredibly well aligned, with himself alone owning a staggering 8,781,692 shares (worth around $40m at the current share price). Considering the shares traded at $7 after the demerger took place, Guscic has taken a $21m haircut – something he will want to rectify quickly.

Management Incentives

Management is incentivised through either cash or equity-settled performance rights. These performance rights are issued annually to the Managing Director, Chief Operating Officer, and Chief Financial Officer. As part of the FY24 management performance rights issue, John Guscic (MD), Shelley Beasley (COO), and Tony Ristevski (CFO) were issued 435,908, 118,376, and 57,389 performance rights, respectively. These performance rights will convert 1:1 to WEB shares if the vesting conditions are met. The vesting conditions for the performance rights are as follows:

Total Shareholder Return (TSR) condition (50% weighting) - market comparative TSR metric tested over the three-year period starting 1 April 2023 and ending 31 March 2026 compared to the S&P/ASX 200 listed entities (excluding banks, resource companies, listed property trusts, ETF/index based companies); and

Absolute EBIT condition (50% weighting) - EBIT CAGR tested over the three-year period starting 1 April 2023 and ending 31 March 2026.

I believe these vesting conditions strike the right balance between ensuring that management is cognisant of both the long-term performance of the business and the share price when making decisions.